Arbitrum Chain Use Cases: A Summary for Builders

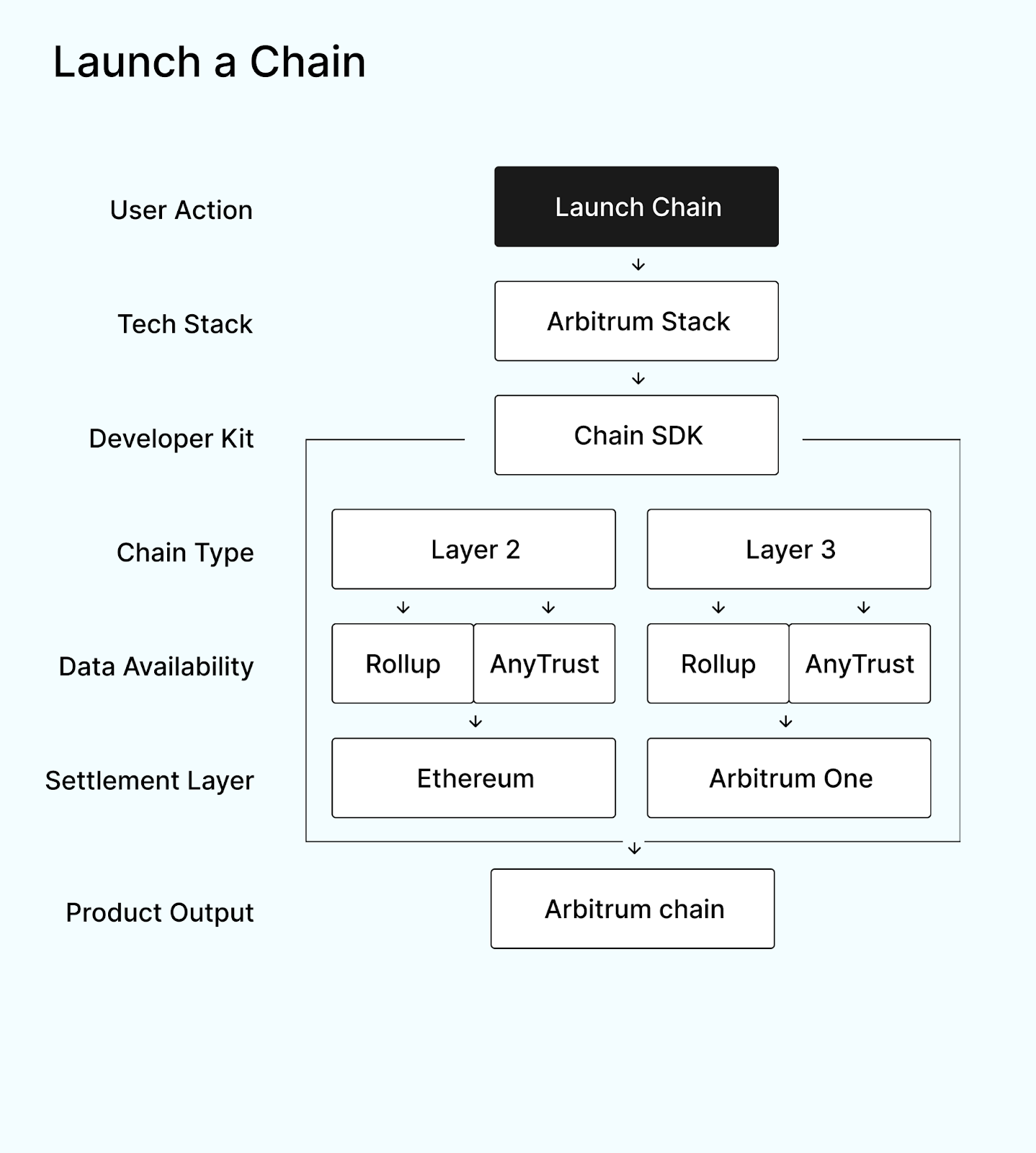

Thinking about becoming an Arbitrum chain, but don’t know exactly where or how to start? Whether you’re building a game, DeFi protocol, or even a loyalty ecosystem, Arbitrum gives you the ability to spin up your very own Arbitrum chain using the Arbitrum stack. With it, you’ll be able to customize every aspect of your chain (such as performance, costs and governance) exactly to your liking. Your Chain. Your Rules. So, let’s dive in.

The Basics

Arbitrum chains are powered by the Arbitrum stack, the same technology that runs Arbitrum One. This means that when launching an Arbitrum chain, it will automatically inherit tools such as compression, fraud proofs, compatibility with Solidity and Stylus (which allows you to write smart contracts in Rust, C or C++).

Unlike launching an app on Arbitrum One, launching an Arbitrum chain allows you to have your own dedicated environment where you set the rules. This means that you’re fully in control of the governance, and have the ability to set your own upgrade paths. From multisigs, to having a DAO, to being fully permissionless; the decision is up to you.

All Arbitrum chains are natively interoperable with its parent chain; bridging between two different Arbitrum chains would typically route through that parent chain. If you choose to do so, you can add additional bridges for UX. The building blocks of an Arbitrum chain can be broken down into four main parts:

The Settlement Layer

The settlement layer is where your chain posts commitments and finalizes the state. As an Arbitrum chain you will have the option to either settle directly onto Ethereum (as an L2) for maximum security, or to an existing Arbitrum L2, such as Arbitrum One. If you choose the latter option you would be considered an L3 chain, but would have faster finality and lower gas costs.

Data Availability

Data availability refers to how transaction data is published to allow anyone to verify it. As a rollup, every byte of data is stored on Ethereum for trust minimization. Alternatively, as an AnyTrust chain, a committee will sign off on the data availability, slashing costs but introducing light trust assumptions. You can choose between rollup or AnyTrust, regardless of whether you are an L2 or L3 chain.

Custom Gas Token

Gas token refers to the currency that pays for execution. As an Arbitrum chain, you will be able to choose ETH as your gas token or any ERC-20 token - this includes loyalty tokens, governance coins or gaming tokens, whatever fits your boat!

Sequencing and MEV

Sequencing and MEV refer to how transactions are ordered. You have the option to stick with the simple first-in-first-out method, or you could experiment with batch auctions, pre-confirmations, or latency-optimized approaches such as Timeboost.

Arbitrum Chain Use Cases

With the basics covered, you’re now probably wondering how this all looks in practice. The power of Arbitrum chains is that they allow different types of projects to utilize technology in a way that works for them. Below are a few use case examples in the Arbitrum ecosystem, each with its very own design priorities, trade-offs and technical levers. These are not rigid categories, but more of a starting point. Anyone who wishes to build their own chain can mix, match and adapt them based on their own product.

RWAs and Enterprise

Institutions care about compliance, governance, and maximum security.

- Settlement: usually L2s that settle directly onto Ethereum for maximum trust and compliance.

- DA Layer: Regulatory environments oftentimes demand Ethereum DAs.

- Gas Token: often ETH, though some institutions experiment with stablecoins or enterprise tokens.

- Sequencing: governed by the enterprise or consortium; allowlists common in early phases.

- Example: Robinhood, building an Arbitrum chain that is focused on supporting the tokenization of RWAs.

Creator Economies

Creator-focused chains want predictable royalties and seek low-cost minting and trading.

- Settlement: L3s that settle onto Arbitrum One and are optimized for mint and trade.

- DA Layer: AnyTrust or external DA for very low-cost mints and trades.

- Gas Token: ETH or a creator token; projects sometimes sponsor the first mint.

- Sequencing: custom ordering rules to prevent front‑running and enforce fair drops.

- Example: RARI Chain, an NFT Arbitrum L3 that enforces royalties at the protocol level to guarantee creator revenues.

Branded Ecosystems

Brands aim to unify loyalty, commerce, and community engagement, usually under one token economy.

- Settlement: L3s that settle onto Arbitrum One, dedicated to a brand or DAO ecosystem.

- DA Layer: AnyTrust for cost control and quick confirmations.

- Gas Token: Brand token (loyalty or governance token.)

- Sequencing: brand‑run sequencer, sometimes starting with allowlists for apps.

- Example: ApeChain, a branded Arbitrum L3 chain that uses its native ApeCoin (APE) as gas to tie games, loyalty, and commerce together.

High-Performance DeFi

DeFi protocols like orderbooks and perps need speed, fairness, and predictable sequencing. Arbitrum gives them isolated blockspace to tune exactly how markets run.

- Settlement: Can be L2s or L3s, with focus on fast settlement and top security.

- DA Layer: Rollup if censorship resistance is critical; AnyTrust if costs dominate.

- Gas Token: ETH for liquidity alignment or a protocol token for governance/economics.

- Sequencing: highly customized (e.g., batch auctions, Timeboost) to manage MEV and ensure fairness.

- Example: Plume, building a high-performance DeFi hub using Arbitrum technology.

Gaming

Gaming chains are often high-volume and user-facing, they prioritize UX, ensuring a smooth gaming experience. Players would not want to be thinking about gas or latency, which means that gaming chains often prioritize instant actions and low costs.

- Settlement: L3s that settle on Arbitrum One.

- DA Layer: AnyTrust to keep transaction costs low.

- Gas Token: ETH or the in-game token, subsidized with relayers for gasless UX.

- Sequencing: Dedicated sequencer for predictable ordering, pre-confirmations for instant transactions.

- Example: Xai, a gaming-focused Arbitrum chain that settles onto Arbitrum One. Powers multiple games with low fees and smooth onboarding.

Decentralized Infrastructure

Infrastructure networks need to handle billions of small transactions, oftentimes way too many to make any sense for them being on Ethereum.

- Settlement: L3s that settle onto Arbitrum One, because billions of small transactions demand low-cost infrastructure.

- DA Layer: AnyTrust to minimize storage costs, with periodic checkpoints to the parent chain.

- Gas Token: the project’s own token, used to incentivize contributors and pay for gas.

- Sequencing: lightweight, often optimized for batching many small events.

- Example: WeatherXM and other DePIN projects.

Your Chain. Your Rules

Arbitrum provides the space for you to create your own chain exactly the way you want it. Gaming chains will have the opportunity to scale player activity without having to worry about high gas costs, brand-focused chains will be able to unify loyalty under their own tokenomics, and DeFi chains will be able to design markets that allow them to customize sequencing and MEV rules.

Different use cases will each be able to tailor Arbitrum technology according to their own needs. As builders, you will be able to decide the trade-offs between cost, security, and performance while being able to innovate. Your Chain. Your Rules.

Ready to get started? Complete our form and get in touch.