How Rise Leverages Arbitrum to Power Global Payments at Scale

When finance and ops teams pay employees and partners across borders, three things are core to the experience: liquidity, latency, and cost.

Rise sets out to build a single global payroll infrastructure that pays workers anywhere, compliantly and instantly. A core feature of the platform is native USDC and USDT funding and withdrawals, allowing payers to fund based on their preference while recipients choose the stablecoin that works for them where they live. In practice, USDC tends to dominate in the US, EU, and much of APAC, while USDT is more commonly used across LATAM, Africa, and parts of APAC.

To scale their rails with lower fees and faster settlement, Rise integrated Arbitrum One to utilize its high-throughput, low-cost design and deep stablecoin liquidity. As of December 2, 2025, Arbitrum One showed roughly $8.82B in stablecoin market cap, with about $6.6B in USDC (USDC + USDC [Hyperliquid]) and approximately $984M in USDT, with an asset mix of 80% USDC / 12% USDT.

Against that backdrop, Rise’s own platform totals underscore the scale of demand. Across all of Rise’s rails, including fiat and multiple chains offered, they show a lifetime volume of $1B+, with $700M in the last 12 months. The funding mix over that period is consistent: deposits are 30% crypto / 70% fiat, while withdrawals are 40% crypto / 60% fiat, a pattern that reflects customers funding from where it’s convenient and recipients increasingly choosing to exit through liquid, low-friction stablecoin rails.

Rise on Arbitrum

Looking at Rise’s activity, a significant share of its onchain volume runs through Arbitrum One.

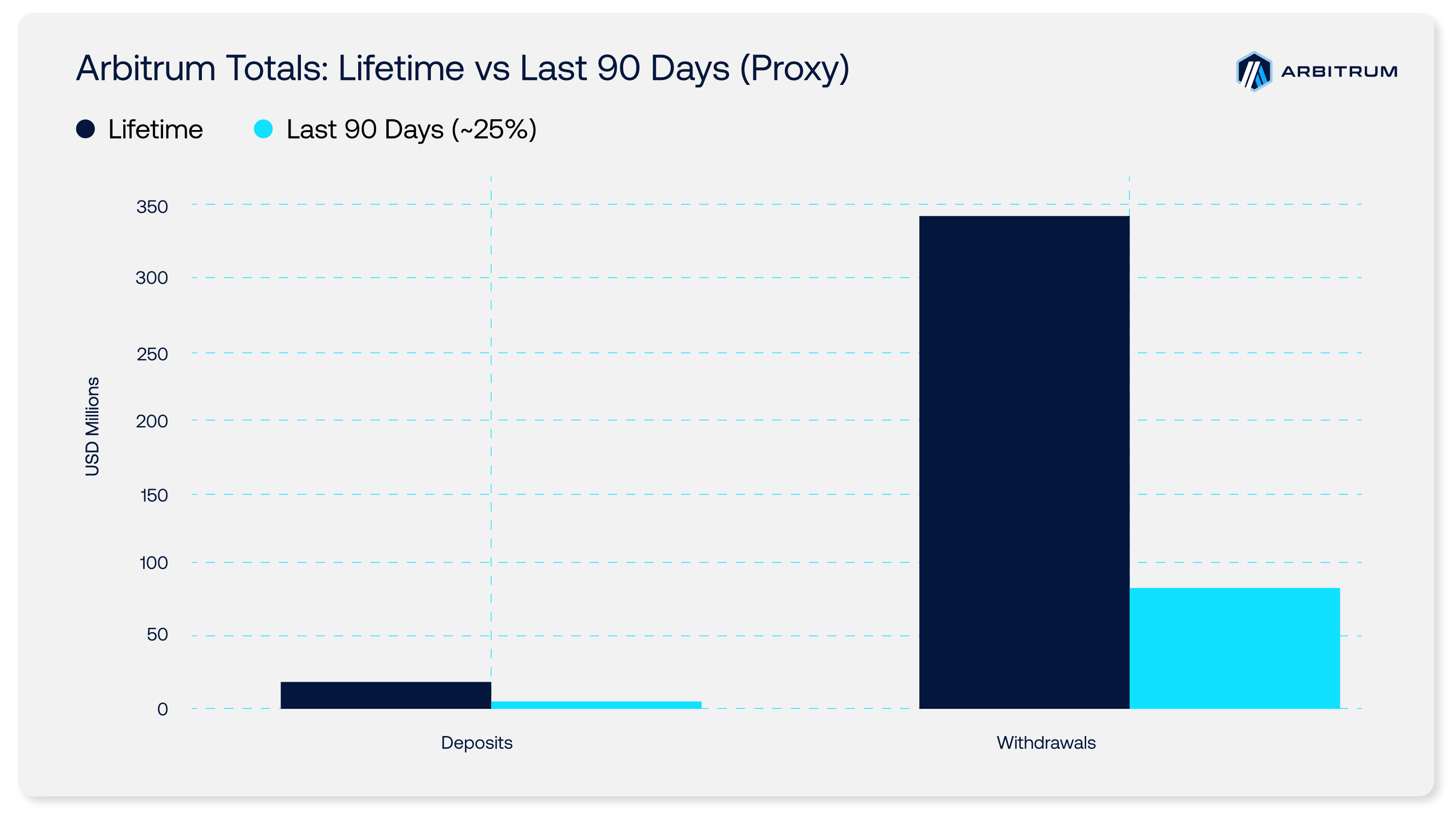

As shown in the figure above, of Rise’s onchain volume, around 80% of all withdrawal volume runs through Arbitrum, while 6% of deposit volume originates there. That pattern indicates that teams can fund from several chains, but when it’s time to pay out, it appears that Arbitrum has become the recipient-preferred payout rail that is fast, inexpensive, and tightly connected to off-ramps.

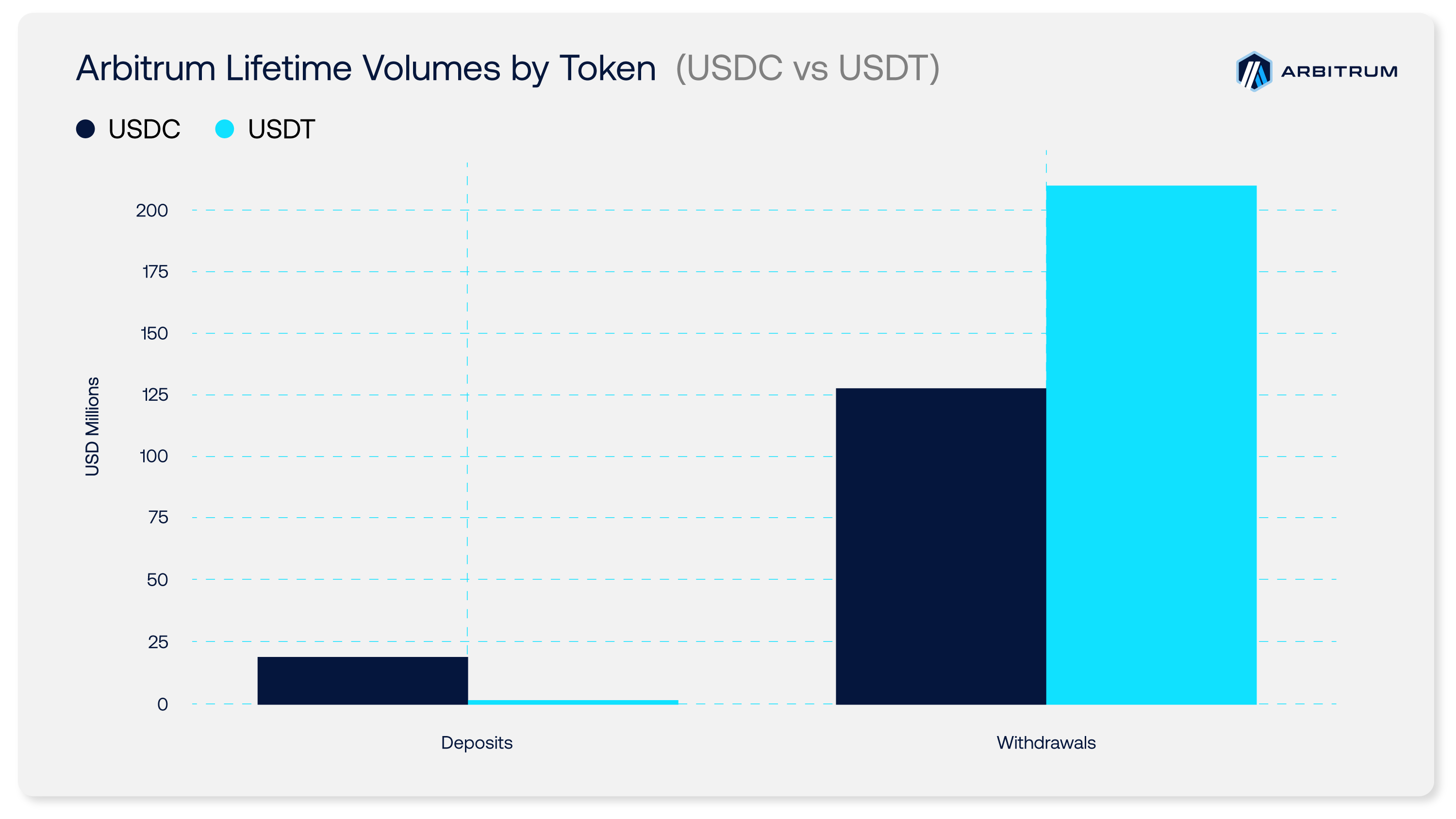

The figure above further highlights the scale of stablecoin flows Arbitrum is carrying for Rise:

- USDC deposits: $17M

- USDC withdrawals: $131M

- USDT deposits: $1M

- USDT withdrawals: $210M

Taken together, these charts highlight Arbitrum as Rise’s primary onchain exit route, moving over $340M in lifetime USDC/USDT withdrawals and handling the overwhelming majority of onchain payouts.

Momentum is building, too: the last 90 days are ~25% of lifetime totals (proxy), pointing to an accelerating run rate as more corridors and use cases switch on.

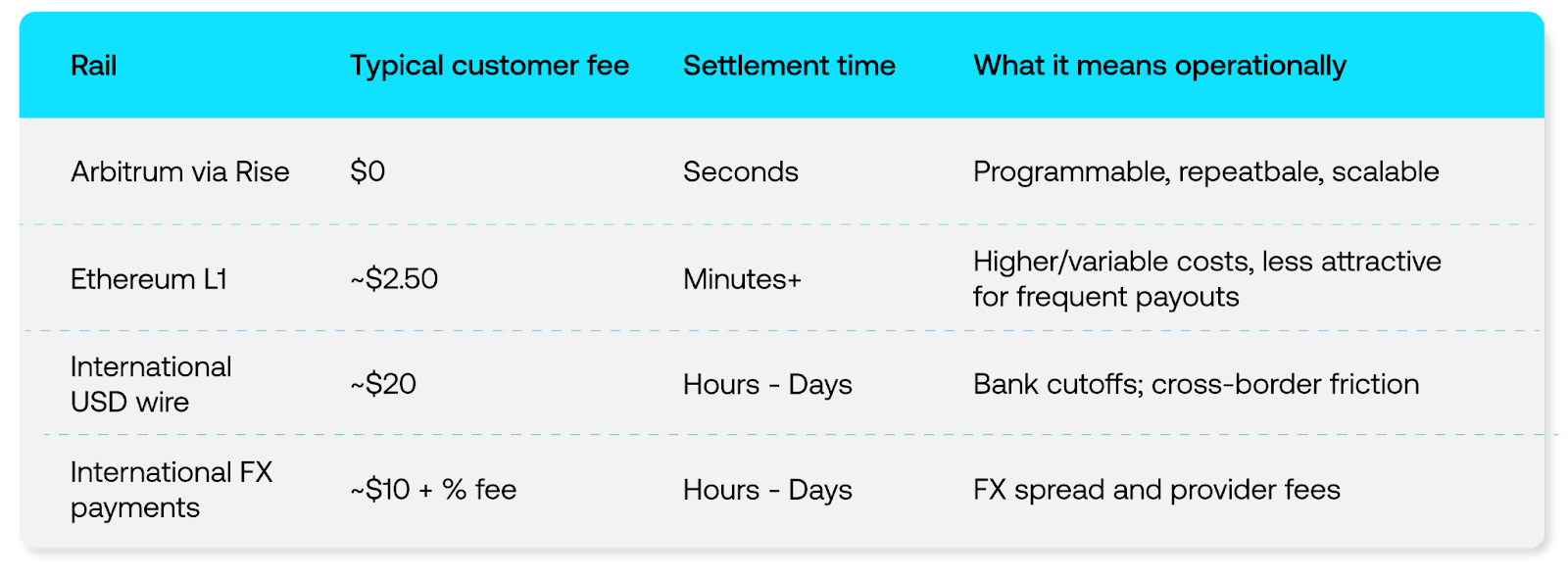

The average Arbitrum payout is $1,500 — large enough that wire/FX fees hurt on legacy rails, small enough that $0 fees on Arbitrum flips the math. Rise makes small and mid-sized disbursements economical, saving up to ~5% vs ACH, wires, and L1 (per Rise).

The Scalable Payments Pattern

Companies want cross-border payouts that feel instant, predictable, and low-friction. Arbitrum brings the liquidity and near-instant confirmations, so platforms like Rise can execute rules-based payouts without manual batching or bank cutoffs, letting their customers fund how they like, and recipients cash out how they prefer. Here’s what it looks like in practice:

Step 1: Fund (keep treasury optionality)

Customers fund their accounts in fiat or crypto and can mix flows (fiat→crypto, crypto→fiat, fiat→fiat, crypto→crypto). You don’t have to rewire your treasury on day one; add rails as use cases expand.

Step 2: Program (turn policy into code)

Smart contracts encode who, how much, currency, timing, and limits/approvals. That removes handoffs, timing risk, and reconciliation guesswork.

As Rise explains it: “automated, rules-based reliability at scale with no manual steps, no batching delays, and no risk of human error.”

Step 3: Execute on Arbitrum (seconds, not days)

When triggers fire, payouts execute on Arbitrum and confirm in seconds. On Rise, Arbitrum payouts carry a $0 customer fee, making micro-to-mid payments viable at scale.

As Rise explains it: Arbitrum “enhances smart-contract automation” and “speeds up settlement” while keeping costs low.

Step 4: Deliver & Reconcile (meet recipients where they are)

Recipients withdraw USDC/USDT or off-ramp to local currency through integrated routes, with a clean audit trail for finance and compliance.

What Businesses Can Take From This

Zero-fee Arbitrum payouts on Rise flip unit economics for small and mid-sized transfers; programmability removes manual steps and timing risk; and liquidity depth shortens the last mile to local currency. It’s a repeatable pattern for contractor, marketplace/vendor, and treasury flows today, and at a larger scale tomorrow.

Contact us to learn how Arbitrum can impact your business

Sources & Disclosures

Sources

- Arbitrum One values are pulled from Entropy's Dashboard

- Rise platform metrics were provided through written Q&A (Dec 2025)

Disclosure

The information provided is for informational purposes only and does not constitute financial, legal, or investment advice. Please conduct your own independent research and consult with a qualified professional before making any decisions. This content does not constitute an endorsement or sponsorship of any product, service, project, or entity mentioned.