Dynamic Pricing on Arbitrum: What Just Changed

Dynamic pricing is an Arbitrum platform direction to make fees more predictable under demand by aligning prices with real network bottlenecks. In the broader Ethereum community, this direction is often described as multidimensional gas pricing, which is how a system prices multiple hardware resource constraints rather than a single unit: gas (see Vitalik Buterin’s post).

The Arbitrum platform’s recent ArbOS Dia upgrade was a meaningful step forward on that path by improving pricing behavior and laying the groundwork to achieve Arbitrum's dynamic pricing goals.

Pricing is a platform primitive

People often talk about gas prices, like it’s a number that goes up and down.

But pricing is really the chain’s throttle. It decides how the network behaves when demand spikes, what kinds of workloads get encouraged, and whether scaling feels sustainable.

For the Arbitrum platform, we believe pricing needs to do three things at once:

- Realize the vision: scale Ethereum execution capacity while still being affordable

- Increase stability: less surge pricing moments and better burst handling under load

- Deliver outcomes: predictable UX for apps, users, and node runners, while being a sustainable path to higher capacity

The anatomy of a transaction, simplified

Transactions have three layers:

- EVM instructions (opcodes): what your transaction actually does

- Gas: the metering unit used to price those instructions

- Real resources: CPU time, memory/cache pressure, disk reads/writes, and long-term state/history growth

The important point: gas is a convenient abstraction, but the system underneath isn’t one-dimensional. When a chain like Arbitrum One is under load, different bottlenecks show up at different times. Some workloads are storage-heavy (disk read/writes, state growth), others are compute-heavy (CPU time). Pricing that treats “everything” as one commodity eventually runs into edge cases.

That’s the “why.” Now the “what changed.”

Step 1: smoother fees under load (live today)

What the ArbOS Dia upgrade introduced

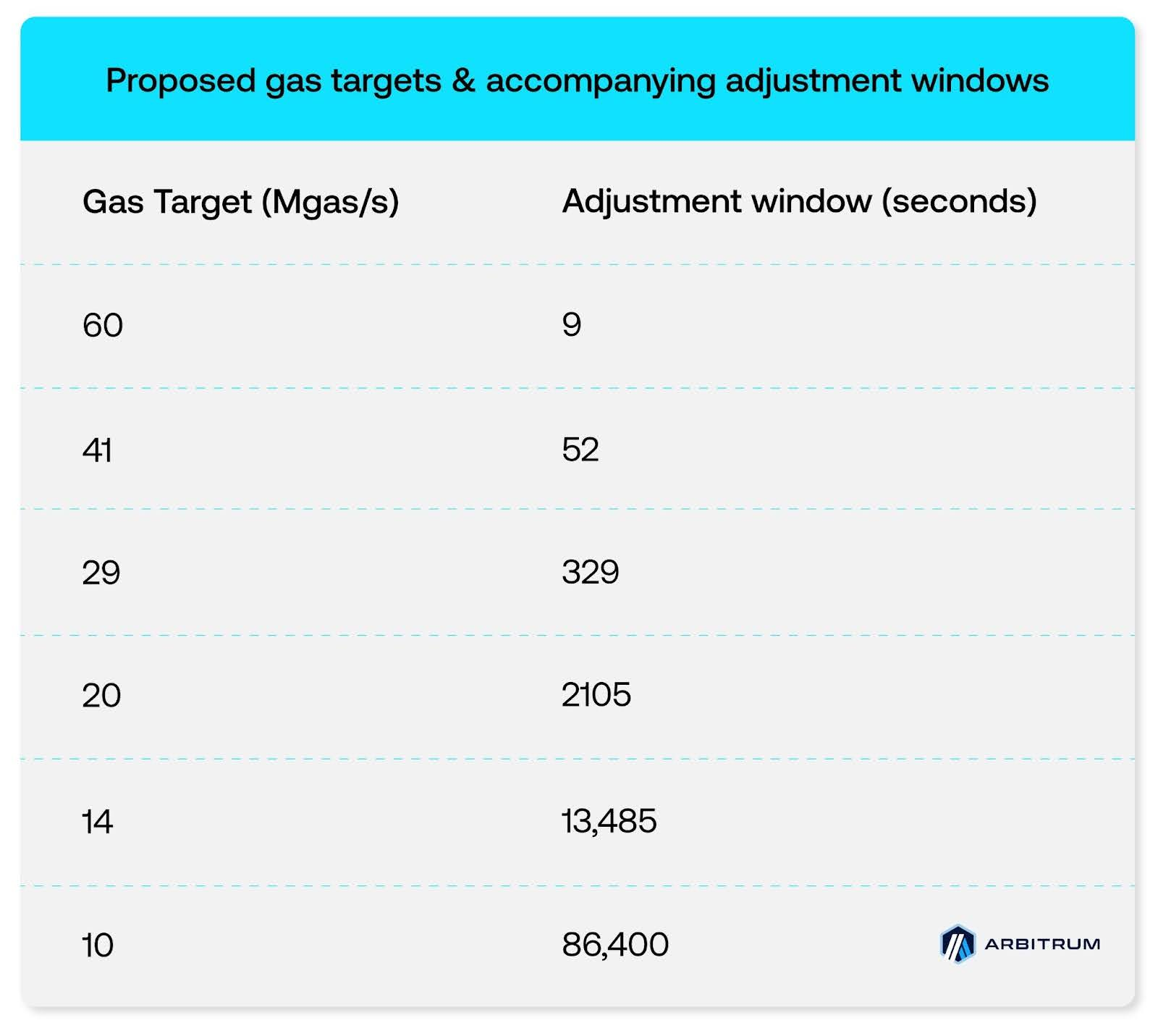

ArbOS Dia (released Jan 8, 2026) upgraded Arbitrum One’s EIP-1559-style L2 base-fee control loop. In simple terms, rather than one target and one adjustment window, Dia introduced multiple gas targets with multiple adjustment windows. The final gas price presented to the user is the result of multiplying the individual prices calculated by each of the six target-window pairs.

As the table below illustrates: short windows handle bursts; long windows anchor long-term capacity.

Why this matters today

Single-window pricing can behave like a springboard: demand rises → base fee snaps upward → the chain feels jumpy.

Dia makes the system behave more like shock absorbers:

- fast windows react early, in smaller increments

- slow windows keep long-run system constraints safe

In practice, that means:

- Better handling of demand bursts

- fewer underpriced submissions that don’t land on the first try (less retry)

- Maintainable state growth

The data: what “smoother” looks like

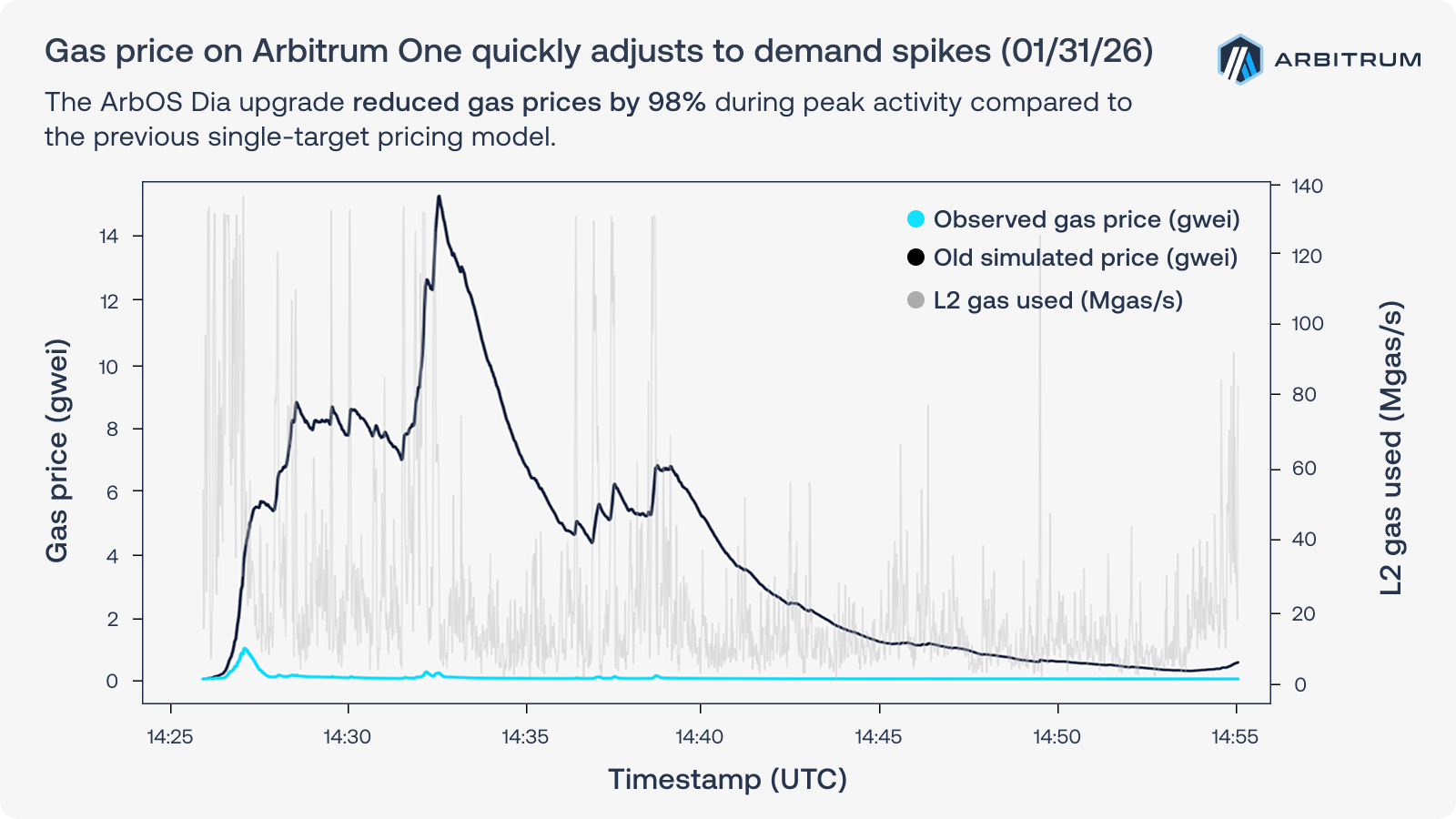

The chart below visualizes that difference: for the same bursty demand pattern, the multi-target approach reduces peak volatility.

The point of this chart isn’t “fees will always be low.” It’s that for the same demand trace, the multi-target approach dampens peak-to-trough swings. This figure is a retrospective simulation that isolates the pricing algorithm’s behavior. Actual fees depend on real-time conditions, including demand, block-to-block variation, and the full fee model (including L1 data costs).

One more change that matters: minimum L2 base fee

Dia also raised the minimum L2 base fee from 0.01 gwei to 0.02 gwei.

This is small, but it’s not cosmetic. It makes spam-style usage less cheap, helps stabilize economics under smoother curves, and supports long-run sustainability.

Who benefits today?

Application builders

- More predictable execution conditions during bursts

- Better UX on “peak days” without redesigning your product around fee cliffs

- More confidence in shipping flows that are sensitive to latency and retries

Protocols / DeFi operators

- Less fee turbulence during market stress, when automation matters most (rebalances, liquidations, arbitrage)

- Cleaner cost expectations for bots and keepers

Chain operators / infra providers

- Smoother control system that doesn’t rely on “raise targets and pray”

- A safer path to increasing capacity over time

End users

- Fewer “surprise” moments where routine actions become irrationally expensive

- A chain that feels more consistent under real usage

Important reminder: Arbitrum fees include both L1 data costs and L2 execution costs. These improvements target the L2 pricing behavior, the part the Arbitrum platform can make smoother and smarter without changing the EVM experience

Step 2: the groundwork to be resource-aware (in progress)

Smoothing price volatility is only the first step.

Dia also upgraded Arbitrum’s State Transition Function (STF) to track a transaction’s gas usage across multiple resource types, including computation, storage access, storage growth, and history growth, instead of only a single blended signal.

This is the quiet part that enables the loud part later:

- Before: “we saw X gas”

- After: “we saw what kind of real resource cost that gas represented”

The ArbOS Dia upgrade added the measurement and accounting foundations as well. It did not flip on the full dynamic pricing model. The platform approach is: instrument → validate → benchmark → then turn knobs responsibly.

Step 3: dynamic pricing as the platform end state

The end goal is straightforward to explain:

- When storage growth is scarce, storage-heavy transactions should face the strongest pressure.

- When compute is scarce, compute-heavy transactions should face it instead.

- When nothing is scarce, pricing shouldn’t manufacture scarcity.

That’s dynamic pricing: fees follow the bottleneck, not a single proxy.

The benefit isn’t just “fairness.” It’s that capacity improvements like hardware, software, and execution performance can translate into higher sustainable throughput without constant, painful repricing debates. If you follow Ethereum’s upgrade cycle, you’ve seen how much coordination it takes to keep one-dimensional gas schedules aligned with real hardware.

How multiclient work fits into the same platform story

Dynamic pricing is economics. Multiclient is the platform work that improves the underlying execution envelope and reduces “single-client” risk. In practice, multiclient means supporting multiple production-grade EVM implementations for Arbitrum, so the network isn’t dependent on one codebase for correctness, performance, and operability.

They reinforce each other:

- Better clients can reduce resource costs (or shift which constraints bind first).

- Dynamic pricing ensures the platform can safely use real resource headroom without over-stressing operators.

This is why Arbitrum’s work with additional client teams (like Nethermind and Erigon, alongside the existing stack) belongs in the same platform narrative: scaling is both software and economics, and the platform needs both.

Closing

The simplest way to understand this dynamic pricing update:

- The Dia upgrade improved how Arbitrum behaves during congestion, with a smoother fee experience

- Dynamic pricing remains the destination, with fees that follow the bottleneck, so scaling remains sustainable long-term

This is a new approach for pricing as a platform: don’t treat it as a one-off release. Treat it as core product infrastructure.

Disclosures

The information provided is for informational purposes only and does not constitute financial, legal, or investment advice. Please conduct your own independent research and consult with a qualified professional before making any decisions. This content does not constitute an endorsement or sponsorship of any product, service, project, or entity mentioned. While the numbers and statistics presented were accurate at the time of publication, timeliness and accuracy cannot be guaranteed beyond this point.